In what is quickly becoming a very ugly situation in Baltimore, protests have grown violent in the wake of Freddie Gray’s funeral. Gray–a black man who died of spinal injuries under suspicious circumstances while in police custody–was laid to rest today under a dark cloud of distrust between citizens and the civil servants whose job it is to protect and serve. Protests have turned to riots as participants hurl rocks and bricks at police, reportedly injuring seven, and wreak serious havoc on police property and local businesses.

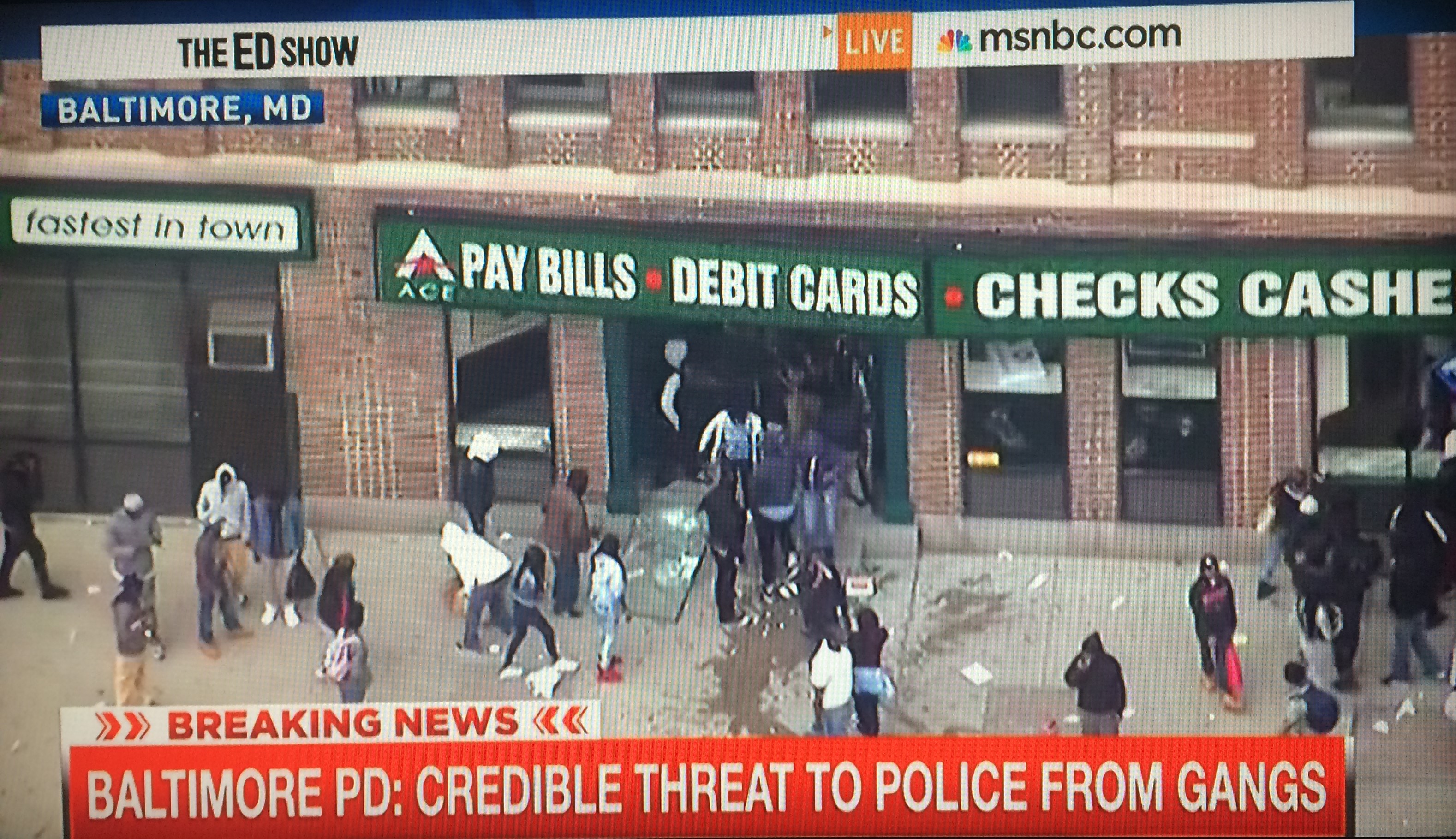

While looting as a protest tool is ineffective and counterproductive, there is some poetic justice in recent footage of West Baltimore residents swarming their local ACE Cash Express–one of the most notorious payday lenders in the country.

Payday lenders are well known leeches on poor urban communities, entangling vulnerable customers in horrendous debt cycles with suffocating interest rates all while using threatening debt collection tactics. Last year the Consumer Financial Protection Bureau (CFPB) settled with ACE for $10 million, finding that the lender “used false threats, intimidation, and harassing calls to bully payday borrowers into a cycle of debt,” while operating a “culture of coercion [that] drained millions of dollars from cash-strapped consumers who had few options to fight back.”

Lenders such as ACE prey on the poor and to great effect. The Center for Responsible Lending has a “fast facts” page up with some disturbing data on the industry. Among its findings:

Since its inception in the 1990s, the payday lending industry has established over 22,000 locations which originate an estimated $27 billion in annual loan volume.

Nationally, there are more than two payday lending storefronts for every Starbucks location.

The typical two-week payday loan has an annual interest rate ranging from 391 to 521 percent.

The “churning” of existing borrowers’ loans every two weeks accounts for three-fourths of all payday loan volume.

Repeated payday loans result in $3.5 billion in fees each year.

Loans to non-repeat borrowers account for just two percent of the payday loan volume.

The average payday borrower has nine transactions per year.

90% of the payday lending business is generated by borrowers with five or more loans per year, and over 60% of business is generated by borrowers with 12 or more loans per year.

If a typical payday loan of $325 is flipped eight times, the borrower will owe $468 in interest; to fully repay the loan and principal, the borrower will need to pay $793.

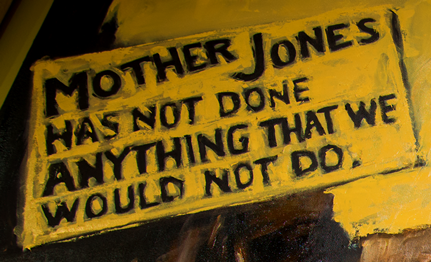

We are not anarchists and can not condone looting, yet there is undeniable justice in the ransacking of ACE Cash Express. We would rather see businesses destroyed that profit from the unjust propagation of poverty and indebtedness–entrapping America’s poor in what amounts to modern slavery–than those local businesses that positively contribute to the neighborhoods in which they exist. Leave CVS alone, Baltimore; they’re not the business that deserves to be burned to the ground.

Leave a Reply