This article originally appeared at the now defunct blog over at TheHundred. You can read all of Alibi Pierce’s electronic music news coverage right here, or at his TheHundred author page (while it’s still up).

SFX (SFXE) stock jumped 25% today on news that the electronic music media conglomerate may go private. Robert F.X. Sillerman, the company’s Chief Executive Officer and Executive Chairman of the Board of Directors proposed a transaction to the board that would buy out all stockholders at $4.75 per share. In a statement released today, Sillerman said:

I have put forward a proposal that offers substantial value and flexibility to all shareholders. Given the inherent risks in our business, my offer guarantees a substantial premium to current price. Those shareholders who are interested in remaining as investors in the company alongside me will have the ability to elect to keep all or part of their shares.

$4.75 may not sound like a high share price for a company that has a foothold in seemingly every facet of electronic music culture. SFX does, after all, own Beatport, Electric Zoo, TomorrowWorld, and a slew of other related companies, from ticket issuers to talent management firms. But they’ve had a shaky run in the stock market since their IPO in October of 2013, with an aggressive expansion marred by rumored bankruptcies and erratic behavior by Sillerman himself. In a November earnings call, SFX announced probable layoffs and an unhealthy reliance on sponsors.. $4.75 sounds like a great deal to investors who have seen the stock hovering near four bucks for a year now. A quick look at their value since launch shows an unmistakable steady decline:

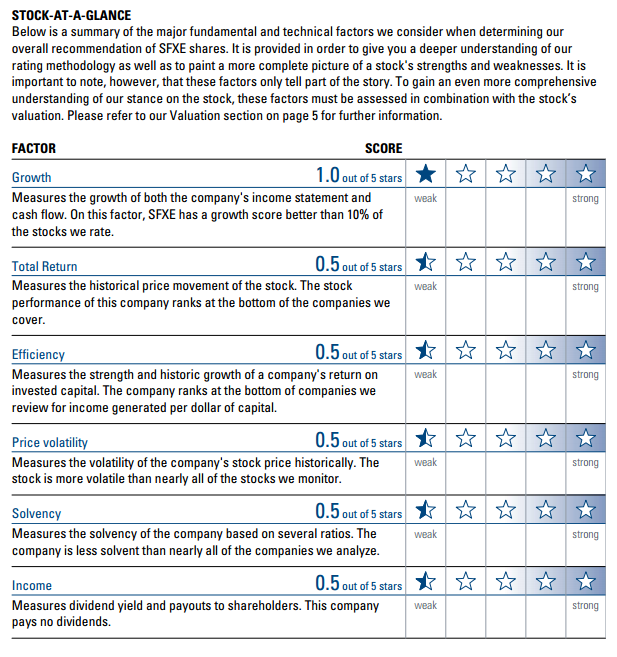

Adding insult to injury, highly respected stock-rater The Street issued a blistering report on SFX earlier this week, rating the company a “sell:”

We rate SFX ENTERTAINMENT INC (SFXE) a SELL. This is driven by multiple weaknesses, which we believe should have a greater impact than any strengths, and could make it more difficult for investors to achieve positive results compared to most of the stocks we cover. The company’s weaknesses can be seen in multiple areas, such as its weak operating cash flow and poor profit margins.

Check their chart below–Among its findings:

*Net operating cash flow has significantly decreased to -$17.78 million or 118.28% when compared to the same quarter last year. In addition, when comparing to the industry average, the firm’s growth rate is much lower.

*The gross profit margin for SFX ENTERTAINMENT INC is rather low; currently it is at 23.34%. Despite the low profit margin, it has increased significantly from the same period last year. Despite the mixed results of the gross profit margin, SFXE’s net profit margin of 1.86% is significantly lower than the industry average.

*Even though the current debt-to-equity ratio is 1.04, it is still below the industry average, suggesting that this level of debt is acceptable within the Media industry. Regardless of the somewhat mixed results with the debt-to-equity ratio, the company’s quick ratio of 0.76 is weak.

*Compared to other companies in the Media industry and the overall market, SFX ENTERTAINMENT INC’s return on equity significantly trails that of both the industry average and the S&P 500.

Leave a Reply